Contact Information

Office: 530-885-9590

Cell: 530-320-3003

E-mail: ken@kencalhoon.com

Office: 530-885-9590

Cell: 530-320-3003

E-mail: ken@kencalhoon.com

Meet your new friend and broker

|

Early in my career my primary focus was on making a buck. Commissions paid the rent. After achieving moderate success in sales, my goals changed. I spent the next 20 years building one of the largest real estate companies in the U.S. With that accomplished, my next priority was to diversify. I expanded my company into mortgage and escrow services, land and commercial development and property management.

Today, my real estate practice is based upon individual quality relationships. My clients benefit from my experience and knowledge. |

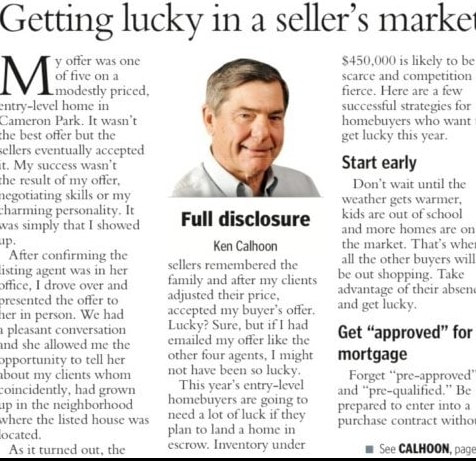

Real Estate Columnist

|

Personal Life |

|

My weekly real estate column appears in several local newspapers including the Mt. Democrat, Village Life and Folsom Telegraph. Google and Money Inc often republish my work and last year I was interviewed by ABC news.

Community LeaderEl Dorado County is a special place to live. Those of us who live here have an obligation to improve and protect our cherished lifestyle. I have served as past president of our local Chamber of Commerce, Director of the El Dorado County Chamber and currently serve on the Chamber’s Political Action Committee. I have served as a real estate commissioner and vice chairman of a large housing agency. I’m a member of the VFW and the Elks.

|

My wife Vicki is a working potter, making functional kitchen art in her studio at our home in Pilot Hill. She sells her work from her web site, CoolClayPots.com. and also through local galleries and art shows in the foothills. We like biking along the American River Parkway and on occasion take our bikes and our RV to Monterey or Santa Barbara.

Vicki and I biking along the American River Parkway in Folsom

|

|

Ken with former El Dorado County Supervisor Michael Ranalli

|